Tesla faces its gravest crisis yet with plummeting sales, legal battles, and brand toxicity. Can Musk’s desperate sales intervention save the company he built?

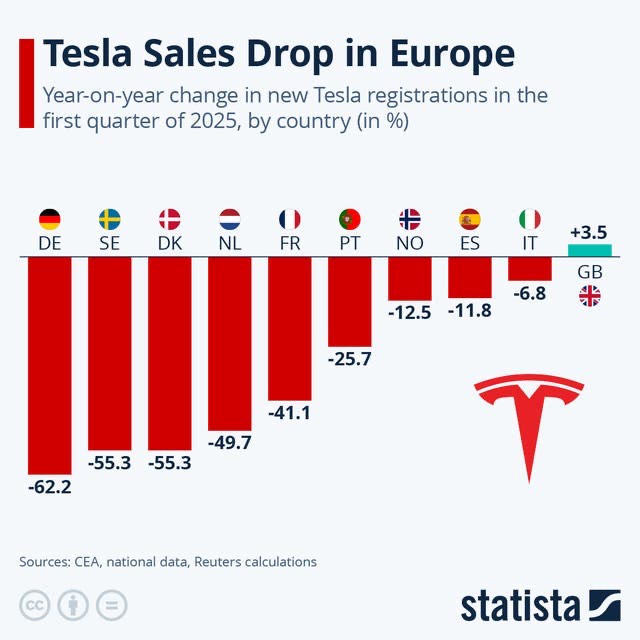

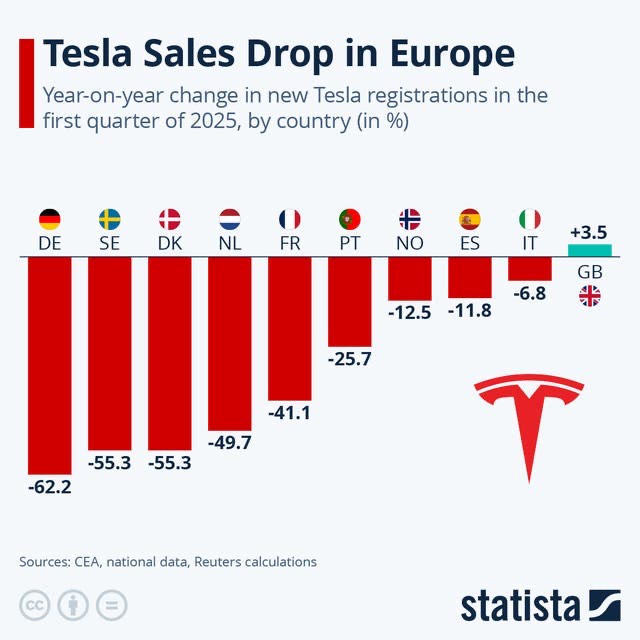

The numbers tell a brutal story. Tesla’s second-quarter deliveries plummeted 13.5% year-on-year to just 384,000 vehicles, whilst European sales collapsed by as much as 45% in early 2025. Even in Tesla’s stronghold markets of China and the United States, rivals including BYD, Volkswagen, and Hyundai are systematically dismantling the company’s once-impregnable market position.

What began as isolated competitive pressure has metastasised into an existential crisis encompassing product stagnation, mounting legal challenges, and a brand toxicity that would have been unthinkable just two years ago. Elon Musk’s response – personally commandeering Tesla’s sales operations from the company’s headquarters – represents either inspired leadership or desperate theatre. The evidence suggests the latter.

Tesla’s troubles extend far beyond routine quarterly fluctuations. Industry analysts point to a fundamental product problem: the company has launched no genuinely new mainstream models since the divisive Cybertruck, leaving its core range looking increasingly antiquated. The Model S and Model X, now approaching their second decade, lack the technological edge that once justified premium pricing, whilst even the refreshed Model 3 and Model Y variants have failed to generate meaningful market excitement.

Manufacturing bottlenecks from Model Y production transitions have exacerbated inventory buildups, creating the paradox of falling sales alongside unsold stock. “Tesla is caught between worlds,” explains one former executive who departed the company last year. “They’re trying to maintain premium positioning whilst competing on volume, and it’s not working.”

The human cost of these missteps extends beyond shareholders. Recent months have witnessed an exodus of senior talent, including the head of North American sales and key battery engineering leaders, suggesting internal recognition that current strategies are failing.

Perhaps more damaging than operational setbacks is Tesla’s reputational crisis. Musk’s increasingly vocal political alignment, particularly his association with Donald Trump, has triggered what industry observers term a “consumer revolt” in traditionally progressive markets where Tesla once dominated.

The “Tesla Takedown” movement, documented across social media platforms, encompasses everything from organised boycotts to physical vandalism of vehicles. Resale values have declined accordingly, with specialist automotive data firms recording measurable drops in Tesla’s brand perception scores throughout 2025.

“We’re seeing something unprecedented,” notes Professor Sarah Davidson, who studies automotive consumer behaviour at Warwick Business School. “Political polarisation is directly impacting purchase decisions in ways we’ve never measured before. Tesla owners are reporting embarrassment about their vehicles.”

Tesla’s troubles extend into America’s courtrooms, where multiple high-stakes cases threaten both immediate operations and long-term viability. California’s Department of Motor Vehicles is pursuing a 30-day sales ban over allegedly misleading advertising of Autopilot and Full Self-Driving capabilities, a move that would devastate Tesla’s largest single market.

Simultaneously, a wrongful death trial in Miami centres on Autopilot’s role in a fatal 2019 crash, with potential punitive damages that could establish precedents for autonomous vehicle liability. Legal experts suggest the outcome could fundamentally reshape how self-driving technologies are marketed and deployed. Tesla’s very own Trolley Car Problem.

Beyond these headline cases, Tesla faces a growing constellation of “phantom braking” complaints, quality control lawsuits, and antitrust challenges to its repair monopoly. Each represents not merely financial exposure but further erosion of consumer confidence in Tesla’s core technologies.

Central to Tesla’s current predicament is a business model that once represented revolutionary thinking but now appears increasingly anachronistic. The company’s rejection of traditional franchise dealerships delivered early advantages in pricing control and customer experience, yet state-level dealership protection laws have created a patchwork of legal restrictions that limit Tesla’s expansion opportunities.

More problematically, Tesla’s insistence on controlling all aspects of vehicle servicing has created what consumer advocates term a “repair monopoly.” Owners face extended delays, higher costs, and limited alternatives when vehicles require maintenance, issues that traditional franchise networks handle through distributed infrastructure and competitive pricing.

“The direct-to-consumer model worked brilliantly when Tesla was a premium niche player with devoted customers,” observes automotive retail consultant James Morrison. “But mass-market consumers expect convenience and choice that Tesla’s current structure simply cannot deliver at scale.”

Industry data supports this assessment. Whilst traditional manufacturers leverage dealer networks to manage demand fluctuations and regional variations, Tesla must shoulder these burdens independently. The resulting bottlenecks in service capacity and inventory management become particularly acute during periods of market stress.

Reports from Tesla’s Fremont headquarters suggest Musk has resumed the hands-on approach that characterised the company’s early years, reportedly employing Musk’ peculiar trademark of sleeping at the facility whilst personally directing sales strategy. The company has rolled out aggressive incentive programmes including discounted financing, complimentary software trials, and targeted offers for military veterans and educators.

These measures represent classic demand stimulation tactics, designed to shore up quarterly numbers ahead of Tesla’s earnings announcement. However, automotive industry veterans express scepticism about their long-term effectiveness.

“Incentives are a sugar rush,” explains former General Motors executive Patricia Williams, now an independent consultant. “They can mask underlying problems temporarily, but they don’t address fundamental issues of product competitiveness or brand perception. Tesla’s challenges are structural, not tactical.”

Stock market analysts echo this assessment, noting that Tesla’s current crisis encompasses precisely the factors that discount-driven sales campaigns cannot address: ageing product lines, manufacturing inefficiencies, legal liabilities, and consumer sentiment.

Tesla’s recovery requires acknowledgement that its original advantages have largely evaporated. The company’s technological lead has narrowed considerably, with competitors matching or exceeding Tesla’s capabilities in areas from battery range to autonomous features. Meanwhile, manufacturing cost advantages have disappeared as established automakers achieve economies of scale in electric vehicle production.

Perhaps most critically, Tesla must confront the limitations of its direct-to-consumer model. Industry experts suggest hybrid approaches, incorporating elements of traditional franchise or agency partnerships, could address current bottlenecks whilst maintaining some operational control.

“Tesla needs to swallow its pride about the dealership model,” argues automotive strategist David Chen. “The best aspects of direct-to-consumer can be preserved whilst addressing the very real scalability and service issues that are alienating customers.”

Similarly, product renewal cannot wait for revolutionary technologies. Tesla requires incremental but meaningful updates to its existing range, coupled with genuinely new models that recapture market imagination.

Where is the Tesla equivalent ‘Dolphin Surf’ or WuLing Baojun’s funky “Yue Ye” a Suzuki Jimny impersonator, on price and desirability?

Tesla’s current predicament represents more than routine corporate turbulence. The company faces simultaneous challenges across every aspect of its operations, from product development to legal compliance to consumer perception. Musk’s personal intervention in sales operations, whilst symbolically significant, addresses none of these fundamental issues.

The electric vehicle market Tesla created has matured beyond recognition, populated by government funded capable competitors offering consumers genuine alternatives. Tesla’s survival depends not on charismatic leadership or promotional campaigns, but on systematic operational reform that acknowledges this new reality.

Whether Musk and his leadership team possess the humility to undertake such reform remains the critical question facing Tesla shareholders, employees, and customers. The company’s next chapter will be written not in boardrooms or Twitter feeds, but in the quotidian work of building better products and serving customers more effectively than increasingly capable rivals.

The Tesla revolution may be ending. What comes next depends entirely on the company’s willingness to evolve beyond the mythology that created it.