The numbers don’t lie: Chinese Electric Vehicles (EV) now command over a quarter of Europe’s electric vehicle market, up from virtually nothing in 2020. This isn’t just market disruption – it’s a complete rewriting of automotive rules. I investigate how European manufacturers are responding to the challenge of a lifetime, and what it means for the future of legacy manufacturers and motoring.

If someone had told you in the days of driving a Ford Cortina with a ten-day holiday in the Costas that by 2025, European roads would be bustling with fully electric cars bearing names like BYD and XPeng, you’d have assumed they’d been at the sherry. Yet here we are, witnessing one of the most dramatic shifts in automotive history. Chinese electric vehicle manufacturers haven’t just entered the European market, they’ve fundamentally altered it.

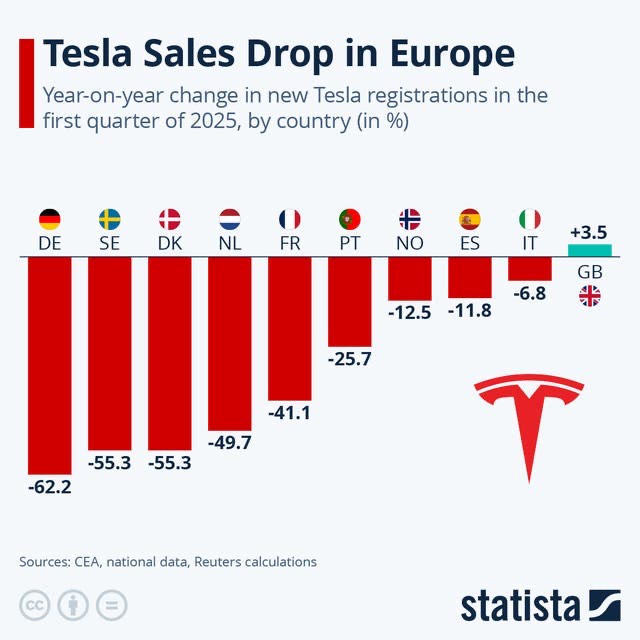

The numbers tell a remarkable story. The market share of Chinese-built EVs (including foreign brands such as Tesla) rose from 3.5% in 2020 to 27.2% of all EVs sold in the EU in the second quarter of 2024. Naturally there are country differences, but across Europe in total that’s not a gradual market entry, it’s a seismic shift that’s left traditional European manufacturers scrambling to respond.

What’s driving this transformation? It’s a combination of competitive pricing, impressive technology, and strategic timing. Chinese manufacturers have leveraged their domestic market scale to achieve manufacturing efficiencies that European competitors are struggling to match. China’s BEV market share hit 27% in 2024, far ahead of the EU (13%) and U.S. (8%).

Take BYD, now a household name in many European markets. Their vehicles consistently undercut European alternatives whilst offering sophisticated infotainment systems, advanced driver assistance features, and impressive safety ratings. The company has demonstrated that affordable doesn’t mean compromised, a lesson that’s resonating strongly with European consumers facing cost-of-living pressures.

In the EU, the new BYD Dolphin Surf is available from €22,000. Compare that to the latest Renault 5 E-Tech EV starting at €27,000 and the Peugeot e-208 at €28,000. With car finance around €30 per month per thousand borrowed, that could mean a €150 per month saving to a cost-conscious family.

The appeal extends beyond mere affordability. These vehicles often feature over-the-air updates, AI-enhanced driving systems, and battery technology that delivers competitive range figures. Chinese manufacturers have essentially leapfrogged traditional automotive development cycles. They’ve moved straight to the latest technologies without the burden of legacy systems.

To meet production the Chinese brands are scrambling to sign up franchisees across the continent to meet sales and after-sales demand. BYD alone is seeking 1,000 service facilities across EU markets this year. Chinese cars adopt the familiar CCS2 charging standard, enabling easy charging at third-party facilities between 65kW and 85kW – not ground breaking but offering acceptable charge times. Manufacturer warranty at six years/150,000km for the car and eight years/200,000km for the battery makes the cars competitive on peace of mind.

European manufacturers haven’t been sitting idle. Stellantis, Renault-Nissan and Volkswagen, along with prestige German brands, are all accelerating their electrification programmes. They’re investing heavily in battery technology and manufacturing capabilities. However, they’re operating from a different starting point, retrofitting existing business models rather than building from scratch around electric-first principles.

The structural advantages Chinese manufacturers possess run deep. They benefit from integrated supply chains, significant government support for the EV transition, and a domestic market that provides both scale and testing ground for new technologies. European manufacturers are now having to navigate this new ultra-competitive landscape whilst simultaneously managing the transition away from internal combustion engines – still in real demand from a population weighing up the EV pros and cons in a media landscape that is fairly hostile to EV in general. Luddite is too strong a word, but the ICE demand is strong due to a Western pro-carbon fuel sentiment and the convenience of familiarity, legacy infrastructure and no range anxiety.

In Europe, BEVs are expected to account for 16.8% of total light vehicle sales this year (compared to 14.1% in 2024). This growth is driven by policy pressure and localised battery production. It’s occurring against a backdrop of intensifying competition that’s forcing down prices and tightening margins across the industry.

The European Union’s response has been swift and decisive. The EU has imposed tariffs ranging from 7.8% for Tesla to 35.3% for SAIC, on top of the standard 10% car import duty. These measures, implemented in October 2024, represent the EU’s largest trade case to date and signal genuine concern about market distortion.

The tariffs are specifically designed to address what the European Commission views as unfair subsidies provided by the Chinese government to domestic manufacturers. However, early evidence suggests these measures may have limited impact. BYD managed to outperform Tesla in European EV sales despite facing higher tariffs, indicating that the competitive advantages run deeper than just pricing.

There’s also ongoing discussion about replacing tariffs with minimum price agreements. These would establish floor prices for Chinese EVs whilst allowing market competition to continue. This approach might prove more effective than blanket tariffs, though negotiations remain complex.

The current situation represents more than just increased competition, it’s a fundamental reshaping of the automotive industry. Chinese brands were responsible for 62% of EV global sales in 2024, demonstrating their dominance extends far beyond Europe.

For European consumers, this shift has brought tangible benefits: more choice, better value, and accelerated adoption of electric vehicle technology. The increased competition is also spurring innovation among traditional manufacturers, ultimately benefiting the entire market.

The industrial implications are significant. European manufacturers are being forced to reconsider their entire approach to vehicle development, manufacturing, and market positioning. Some are forming partnerships with Chinese companies, others are investing heavily in their own capabilities, and all are grappling with the new competitive reality.

This transformation isn’t slowing down. Chinese manufacturers continue to expand their European presence, with many establishing local manufacturing facilities and service networks. They’re also diversifying their offerings, moving beyond basic models to premium segments that directly challenge European luxury brands.

The success of Chinese EVs in Europe reflects broader changes in global automotive manufacturing. It’s a story of how quickly established market positions can shift when new technologies create opportunities for disruption. European manufacturers, once confident in their engineering prowess and brand heritage, are discovering that in the electric age, different rules apply.

Of course, with anything China there’s a darker undertone to all this. Some of the continental boffins are fretting about data privacy. Chinese firms are obliged to share data with state security if asked, and that has set off alarm bells in Brussels and beyond. Imagine your car knowing not just where you’ve been but who you’ve been with, and that information possibly ending up in a CCP filing cabinet. Orwell, anyone?

Some defence ministries have already banned the use of Chinese EVs on or near sensitive infrastructure. One assumes that if your Tesla can dance, your BYD might be able to whistleblow.

Ultimately what we’re witnessing isn’t just a market shift, it’s a case study in industrial transformation. The question now isn’t whether Chinese EVs will continue to gain market share in Europe, but how European manufacturers will adapt to this new reality. The answers will shape the automotive industry for decades to come.

The electric revolution has arrived, and it’s powered by competition that’s forcing everyone to raise their game. For consumers, that’s undoubtedly good news. For the traditional European automotive establishment, it’s the challenge of a lifetime.